The Gazette, 12 April 2019

What is Inheritance Tax?

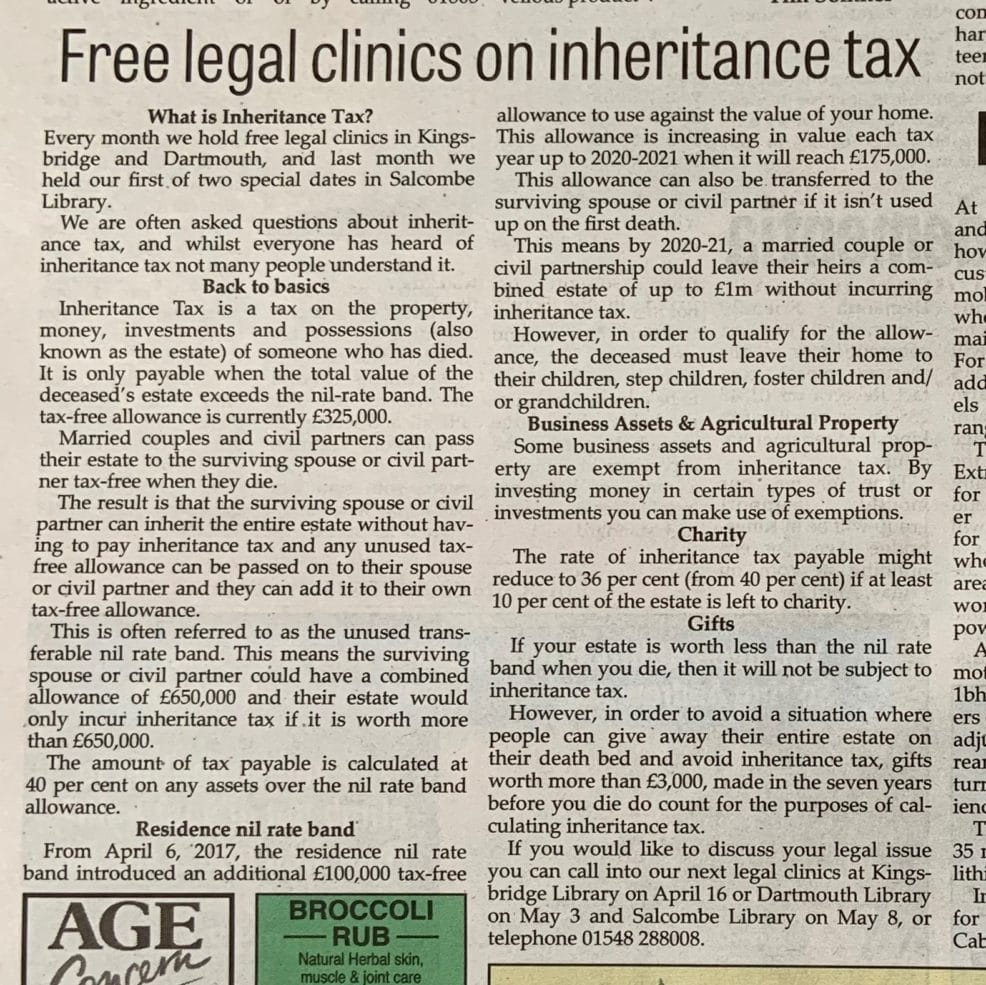

Every month we hold free legal clinics in Kingsbridge and Dartmouth, and last month we held our first of two special dates in Salcombe Library.

We are often asked questions about inheritance tax, and whilst everyone has heard of inheritance tax not many people understand it.

Back to basics

Inheritance Tax is a tax on the property, money, investments and possessions (also known as the estate) of someone who has died. It is only payable when the total value of the deceased’s estate exceeds the nil-rate band. The tax-free allowance is currently £325,000.

Married couples and civil partners can pass their estate to the surviving spouse or civil partner tax-free when they die. The result is that the surviving spouse or civil partner can inherit the entire estate without having to pay Inheritance Tax and any unused tax-free allowance can be passed on to their spouse or civil partner and they can add it to their own tax-free allowance. This is often referred to as the unused transferable nil rate band. This means the surviving spouse or civil partner could have a combined allowance of £650,000 and their estate would only incur Inheritance Tax if it is worth more than £650,000.

The amount of tax payable is calculated at 40% on any assets over the nil rate band allowance.

Residence nil rate band

From 6 April 2017 the residence nil rate band introduced an additional £100,000 tax-free allowance to use against the value of your home. This allowance is increasing in value each tax year up to 2020-2021 when it will reach £175,000.

This allowance can also be transferred to the surviving spouse or civil partner if it isn’t used up on the first death. This means by 2020-21, a married couple or civil partnership could leave their heirs a combined estate of up to £1 million without incurring Inheritance Tax. However, in order to qualify for the allowance, the deceased must leave their home to their children, step children, foster children and/or grandchildren.

Business Assets & Agricultural Property

Some business assets and agricultural property are exempt from Inheritance Tax. By investing money in certain types of trust or investments you can make use of exemptions.

Charity

The rate of Inheritance Tax payable might reduce to 36% (from 40%) if at least 10% of the estate is left to charity.

Gifts

If your estate is worth less than the nil rate band when you die, then it will not be subject to Inheritance Tax. However, in order to avoid a situation where people can give away their entire estate on their death bed and avoid inheritance tax, gifts worth more than £3,000, made in the seven years before you die do count for the purposes of calculating Inheritance Tax.